Garry Tan San Francisco Unicorn Rate

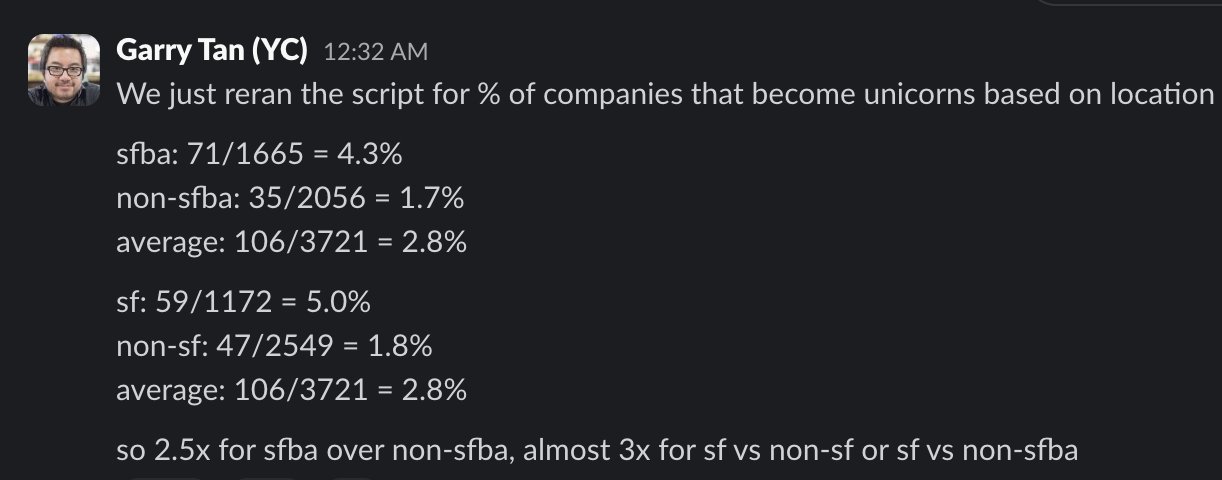

Garry Tan shared some YC data showing San Francisco companies are almost 3x more likely to become unicorns than those outside the Bay Area. SF startups hit about 5.0%, while non-SF ones sit around 1.8%. That’s a massive gap — and it’s no accident.

Marketing Analysis

This is network effect marketing in action. SF builds an ecosystem of success — founders, mentors, investors, and talent all feeding off each other. The same idea applies to marketing: get closer to where success clusters.

Why It Works

- Proximity to capital and mentors speeds feedback loops.

- Environment sets a higher performance standard.

- Success stories attract more ambitious players.

- Learning spreads faster in tight communities.

Examples

- TikTok ads perform best where users already watch short video content.

- DTC brand collabs with Shopify stores boost visibility among proven buyers.

- SaaS startups at YC Demo Day raise faster simply by sharing the same stage.

Analyzed by Swipebot

Loading analysis...