Sugarman Trigger #11 - Current Fads

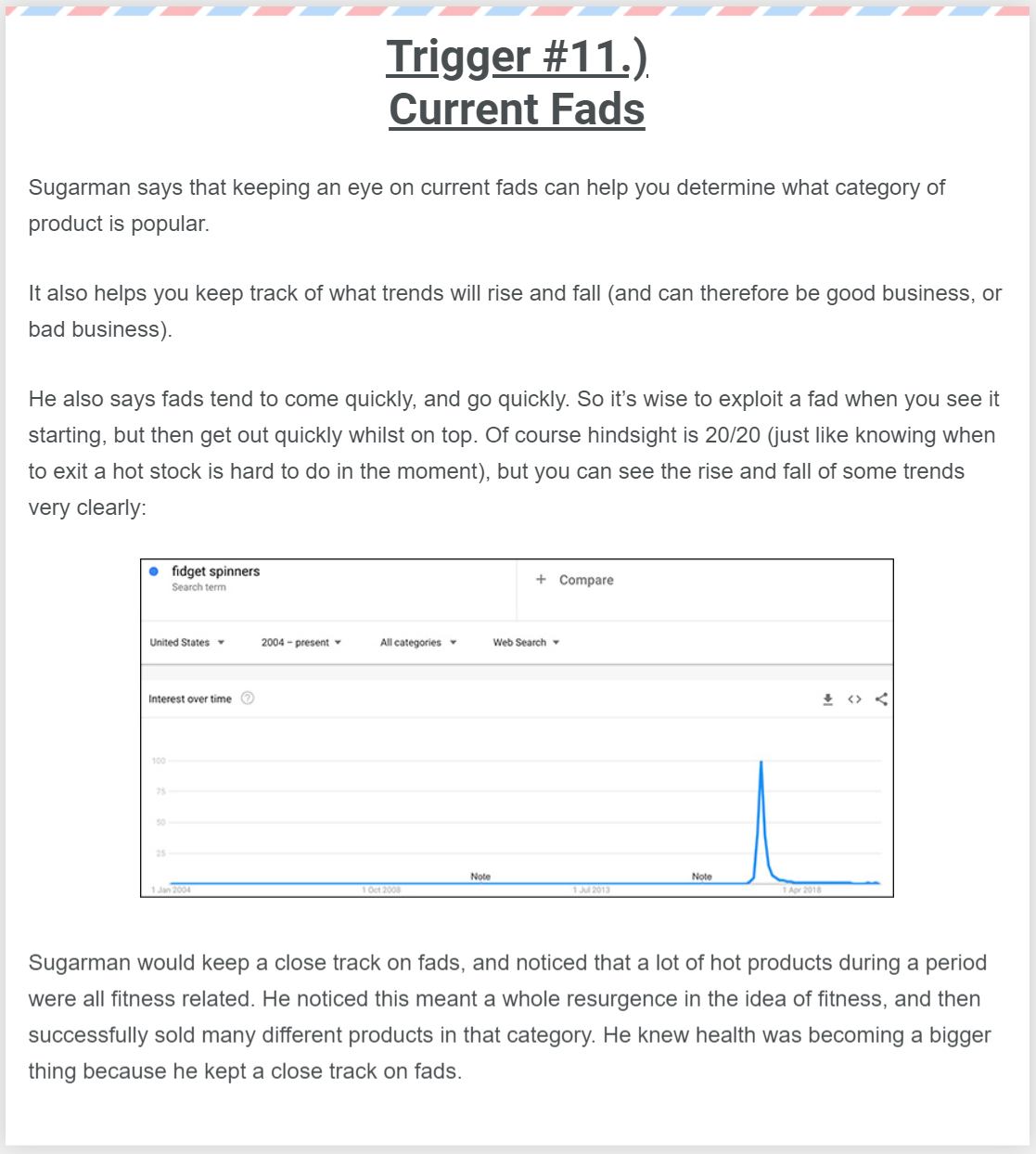

Remember fidget spinners? They shot up like fireworks… then disappeared just as fast. This Google Trends graph says it all: a massive spike, then tumbleweed.

Marketing analysis

Joe Sugarman taught that fads can signal which product categories are about to heat up. Smart marketers don’t go “all-in” on one fad. They watch where fads cluster and use that insight to spot bigger, lasting movements.

Why it works

- Fads = early indicators of mass consumer interest

- Quick wins if you act fast

- Avoids long-term risk by exiting early

- Great way to test and learn what’s trending

- Patterns of fads often reveal long-term markets

Examples

- Fidget spinners → short-term toy gold rush

- Keto snacks → led to ongoing health food boom

- TikTok filters → inspired entire UGC ad industry

- Wordle → mini craze that proved puzzles could still go viral

Analyzed by Swipebot

Loading analysis...