🎤 The SWIPES Email (Friday, February 6th, 2026)

SwipeFile: What's actually working in marketing.

CopywritingCourse: Sell your stuff better.

Swipe:

This guy said everyone wanted him to tone down his personality, so his real estate sign looked pretty standard and boring like this:

....but then he decided to go full OPPOSITE and created this amazing piece of insanity 😂

@realtorscottieh leaned into his personality and it worked! It was more fun for him, his clients, and he got to be himself instead of toning it down.

Wisdom:

Wanna see how this newsletter exists every week, lands paid sponsors, and keep it growing every single month?

In the video I take you behind the scenes, open up my Kit editor, and make this email from a set of pre-defined parameters.

In this video, I break down my full newsletter workflow from idea to send so you can use the same system for your own list, even if you're just starting.

Interesting:

There's an enormous amount of hype around a lot of IPO's this year:

Pretty much all of them are AI related companies. This reminds me a lot of the year 2000 when every company going public was an internet company.

Around March 2000 a peak hit, and everything went wayyyyy down for like 2 years.

Now 26 years later the results are in, and the hype was real.....the internet WAS INDEED THE NEXT BIG THING! However, it took a bit longer to fully materialize than initially predicted.

The "bubble" was formed by people thinking all the companies going public then were already super valuable, when in fact many of them barely had revenue or profit for a long time.

But now the hype has caught up and so much of the world has gone online or digital since then.

I suspect we'll see a similar trend with AI: - A lot of hype because everyone knows AI is the biggest thing ever. - A drawdown at some point as valued get too inflated. - Many companies go out of business and confidence wanes. - Several companies from this era will emerge at 10x, 100x, or 1,000x their size.

My personal investing is pretty simple, and this was my thought from 5 years ago. My only change so far is I stopped buying a China index fund on a monthly basis.

Picture:

Me and my wife did a little trip with our 3 month old son, and he was a great little travel buddy!

Drinking wine together 🤣

Look at him smiling!! He's starting to do that a lot now and I love it 😍

Wifey & baby 🙂

Fortunately he likes loud situations so when we take him out to places it hasn't been a big problem. Honestly the more noise there is I think he likes it more!

Essay:

Take a look at this graph of how JP Morgan (the bank) is bigger than it's top three competitors in the USA:

When a company is super well run, utilizes more technology, and moves faster, you get these weird outliers that become bigger than EVERYONE ELSE COMBINED.

Apple did this a while ago as it took over nearly the entire smart phone industry:

Tesla is currently doing this with cars, and it's soooooo far beyond the capabilities of legacy automakers.

A prediction that may happen soon is that companies who utilize AI and automation to a massive degree more than their competitors might not only eclipse their competitors, but 100x them.

Like it might be very true in the next ten years the entire S&P 500 index of companies is literally like 5 or 10 giant companies....then 490 smaller ones that almost don't matter compared to the very big ones.

Splurge:

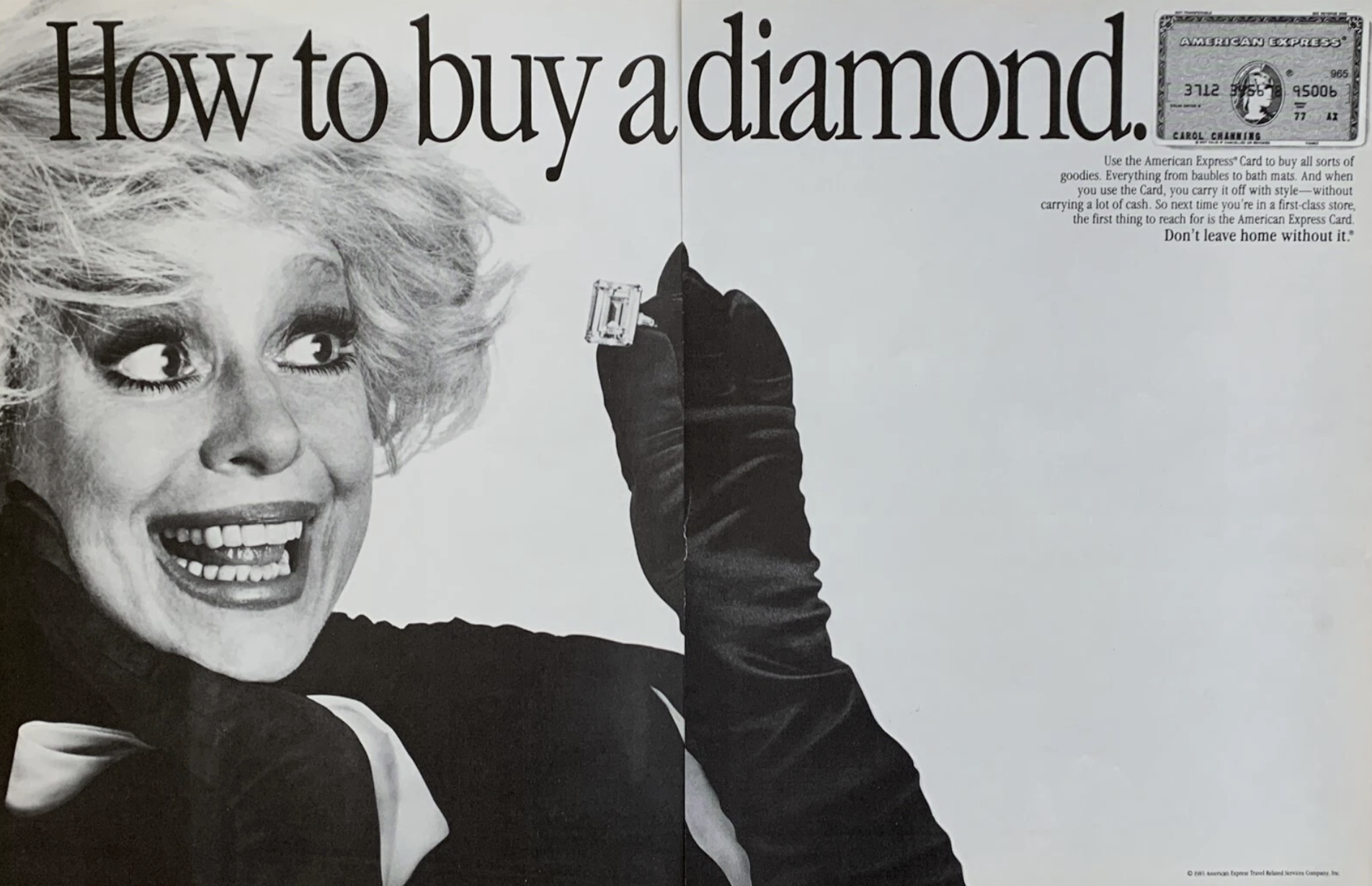

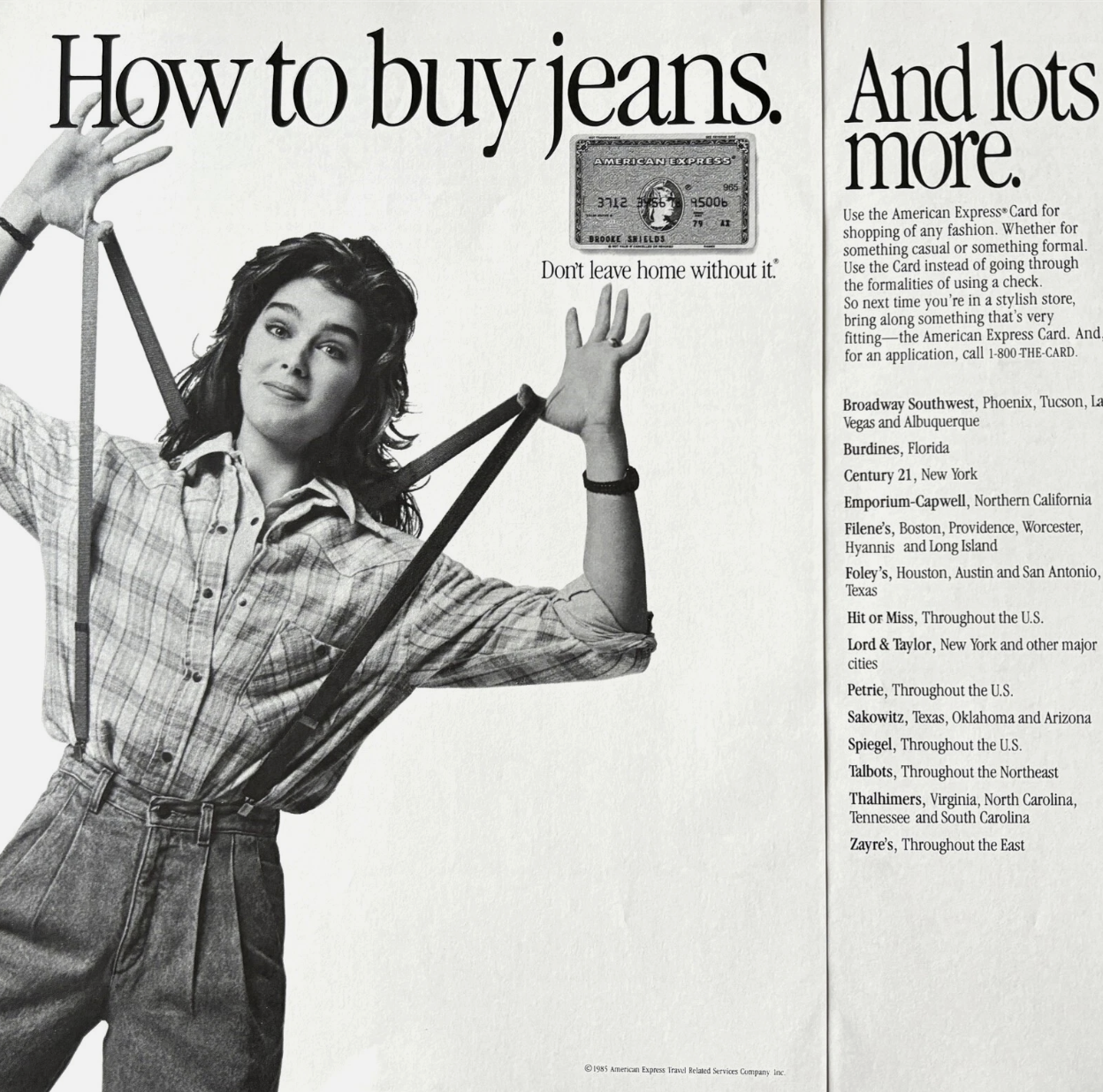

This is a cool set of vintage American Express Ads from when credit cards were a new thing.

They actually had to educate the public that carrying around this piece of plastic could let you buy things versus carrying cash or a check book:

Super cool headlines and imagery on this set of ads, love it!

Hope you have a great weekend!!!

Sincerely,

Neville Medhora